The Ultimate Overview to Using a Secured Credit Card Singapore for Better Financial Monitoring

The Ultimate Overview to Using a Secured Credit Card Singapore for Better Financial Monitoring

Blog Article

Charting the Course: Opportunities for Credit Score Card Access After Personal Bankruptcy Discharge

Browsing the globe of bank card accessibility post-bankruptcy discharge can be a challenging job for people seeking to reconstruct their financial standing. The process involves tactical planning, recognizing credit report intricacies, and exploring different choices readily available to those in this particular situation. From protected bank card as a tipping rock to potential courses resulting in unprotected credit history chances, the journey in the direction of re-establishing credit reliability requires cautious factor to consider and informed decision-making. Join us as we explore the methods and techniques that can pave the means for individuals looking for to restore accessibility to credit cards after facing insolvency discharge.

Comprehending Credit History Essentials

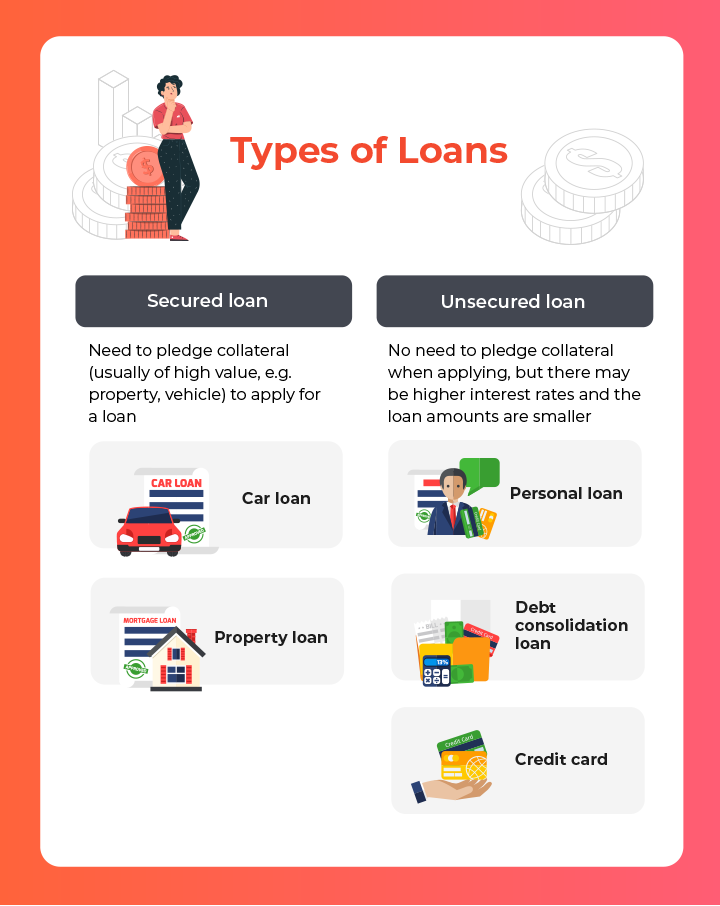

A credit rating is a mathematical depiction of a person's creditworthiness, suggesting to loan providers the degree of threat associated with expanding credit. Several aspects contribute to the computation of a debt rating, consisting of repayment background, amounts owed, length of credit rating history, brand-new credit score, and kinds of debt made use of. The amount owed family member to available debt, also understood as credit scores usage, is an additional essential aspect affecting credit rating ratings.

Safe Credit History Cards Explained

Protected credit cards provide a useful economic tool for individuals seeking to rebuild their credit background following an insolvency discharge. These cards call for a down payment, which commonly establishes the credit line. By utilizing a safeguarded credit card properly, cardholders can demonstrate their credit reliability to possible loan providers and gradually boost their credit history.

Among the key advantages of safeguarded charge card is that they are extra obtainable to people with a limited credit report history or a tarnished credit rating score - secured credit card singapore. Considering that the credit line is secured by a down payment, companies are extra happy to authorize applicants that might not get standard unsafe credit scores cards

Bank Card Options for Restoring

When looking for to restore credit report after bankruptcy, exploring different bank card options customized to individuals in this monetary situation can be useful. Protected charge card are a preferred selection for those seeking to reconstruct their credit rating. By providing a safety deposit that normally figures out the credit line, individuals can demonstrate liable credit scores habits to financial institutions. Furthermore, some banks provide credit score home builder fundings, where the debtor makes fixed monthly repayments right into a cost savings account or CD, ultimately acquiring accessibility to the funds and potentially improving their web link credit rating. Another alternative is ending up being an authorized user on try this web-site a person else's charge card, enabling people to piggyback off their credit score history and potentially increase their very own score. Pre paid cards, while not directly impacting credit history, can aid with budgeting and monetary self-control. Ultimately, some loan providers focus on post-bankruptcy charge card, although these often featured greater fees and rates of interest. By checking out these charge card options for restoring, people can take aggressive steps towards improving their financial standing post-bankruptcy.

How to Receive Unsecured Cards

Monitoring credit history records frequently for any kind of errors and challenging errors can additionally boost credit scores, making individuals extra eye-catching to credit report card companies. In addition, people can think about applying for a protected credit history card to reconstruct credit. Secured credit rating cards need a cash money down payment as security, which minimizes the danger for the provider and enables individuals to demonstrate liable credit score card use.

Tips for Responsible Charge Card Usage

Building on the structure of improved credit reliability developed with responsible monetary administration, individuals can enhance their total economic wellness by implementing essential suggestions for responsible credit card usage. In addition, maintaining a low debt utilization proportion, ideally listed below 30%, demonstrates liable credit scores use and can favorably impact debt scores. Refraining from opening several new credit report card accounts within a brief duration can prevent potential credit rating rating damage and extreme debt buildup.

Conclusion

To conclude, individuals who have declared personal bankruptcy can still access charge card via numerous choices such as secured credit score cards and restoring credit score (secured credit card singapore). see here now By recognizing credit rating essentials, getting approved for unsafe cards, and practicing accountable charge card usage, individuals can gradually rebuild their creditworthiness. It is necessary for individuals to carefully consider their monetary situation and make notified decisions to enhance their debt standing after insolvency discharge

Numerous elements contribute to the estimation of a credit score, including payment background, amounts owed, size of credit history, new credit history, and kinds of credit score used. The amount owed loved one to available debt, additionally recognized as credit scores use, is another important aspect affecting credit history ratings. Keeping an eye on credit scores records routinely for any type of errors and contesting inaccuracies can even more enhance credit ratings, making people extra attractive to credit report card companies. Furthermore, maintaining a reduced debt utilization ratio, ideally below 30%, demonstrates accountable credit rating use and can favorably affect credit history scores.In verdict, individuals who have filed for bankruptcy can still access credit scores cards with different options such as protected credit report cards and restoring credit scores.

Report this page